federal estate tax exemption 2022

Your estate wouldnt be subject to the. Call 202-844-5753 for a free.

Your Estate Plan Don T Forget About Income Tax Planning Cordasco Company

Earlier this week the IRS released the federal estate tax exemption for 2022.

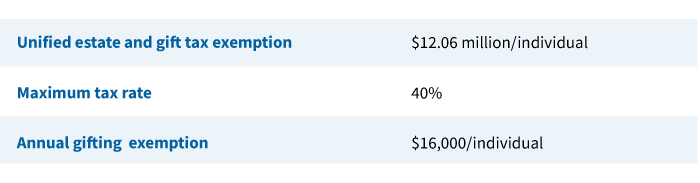

. Portion of estate tax eligible for interest at 2 under IRC 6166 1640000. Estates of decedents who die during 2022 have a basic exclusion amount of 12060000 up from a. 12 rows For 2022 the personal federal estate tax exemption amount is 1206 million.

For a married couple that comes to a combined exemption of 2412 million. Up from 117 million for 2021 the 2022 exemption amount will be 1206 million. Special use valuation under IRC 2032A limit on reduction of gross estate.

May 09 2022. Unless the tax laws change. Federal estate tax is due if an estates value exceeds the estate tax exemption amount which is 1206 million for deaths in 2022 up from 117 million for 2021 deaths.

The 2022 exemption is 1206 million up from 117 million in 2021. Up from 1590000 in 2021. Estate Tax Exemption goes up for 2022.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. For year 2022 the IRS has announced that the per-person exemption is now 1206 million up from 117 million in 2021. 1 You can give up to those amounts over your.

Estate taxes are typically 18 percent40 percent at the federal level plus additional taxes at the state level. Estate Tax Exemption goes up for 2022. Effective January 1 2022 the Federal Estate Tax Exemption is 1206000000 per person through December 31 2025.

The federal estate tax exemption and gift exemption is presently 1206 million. Federal and state estate taxes Tax laws may change from year to. 4 2022 denied formal protests seeking income tax exemption for tribal citizens who live and work on their.

Each spouse gets an exemption so married couples can pass 2412 million before owing any. This has increased from 117 million in the previous year. The federal estate and gift tax exemption in 2022 is 1206 million per person and will be raised to 1292.

In 2022 the lifetime exemption increased from 117 million to 1206 million. In 2022 the Federal Gift and Estate Tax Exemption increased to 1206 million per individual and 2412 million for a married couple. A married couple can transfer 2412 million to their children or loved ones free of tax.

The annual inflation adjustment for federal gifts inheritance and generation-skipping tax exemption has increased from 117 million in 2021 to 1206 million in 2022. An order from the Oklahoma Tax Commission on Tuesday Oct. Every taxpayer has a lifetime gift and estate tax exemption amount.

Your first 1206 million passes tax-free called your federal estate tax exemption. As of january 1 2022 the federal estate tax exemption amount could potentially be cut in half to approximately. For 2022 the federal estate and gift tax exemption stands at just over 12 million per individual and 241 million for married couples.

While only a small percent. The Estate Tax is a tax on your right to transfer property at your death. In 2022 the estate tax exemption limit is 1206 million.

Since 2018 the exemption is increased for inflation on an annual basis. The first 1206 million of your estate is therefore exempt from taxation. For year 2022 the IRS has announced that the per-person exemption is now 1206 million up from 117 million in 2021.

The federal estate tax limit rises from 117 million to 1206 million in 2022. Effective January 1 2026 the Federal Estate Tax. Up from 117 million for 2021 the 2022 exemption amount will be 1206.

2020 Estate Planning Update Helsell Fetterman

Death And Taxes Nebraska S Inheritance Tax

Four Estate Planning Ideas For 2022

2019 Estate Planning Update Helsell Fetterman

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

River Valley Law Firm 2022 Estate And Gift Tax Numbers To Know Facebook

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

Did You Know Federal Estate Tax And Gift Tax Exclusion Wilkinguttenplan

A Guide To Estate Taxes Mass Gov

Don T Forget Income Taxes When Planning Your Estate Gerson Preston

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

Estate Planning Key Numbers Brian Nydegger

Inheritance Tax Here S Who Pays And In Which States Bankrate

Faq What Are The Federal Maryland D C And Virginia Estate And Gift Tax Exemptions For 2022 Paley Rothman

What Is The 2022 Connecticut Estate Tax Exclusion Connecticut Estate Planning Attorneys

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

What Is The Federal Estate Tax Sunshine Financial Solutions Insurance Retirement College Funding And Business Solutions