st louis county sales tax pool cities

St Louis County Tax Fight Heats Up As Region Seeks Economic Unity Nextstl Understanding The Missouri Supreme Court Ruling On Sales Taxes Ksdk Com 2022 Best. They keep most of the sales taxes collected within their boundaries but submit a portion to the pool.

Their large population may result in lesser per capita sales.

. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St. Interactive Tax Map Unlimited Use. Louis County will get to keep more of the sales tax revenue they generate under a bill signed Friday by Gov.

Louis County sales tax rate is 3388 which is made up of a transportation sales tax 05 a mass transit sales tax for Metrolink 025 an additional mass transit sales tax 05 a Regional Parks and Trails sales tax 0288 a childrens trust fund sales tax 025 an emergency communication sales tax 01 a county law enforcement sales tax 05 plus a. 96 and Schatz filed identical state bills asking for reform that would allow cities to keep 50 percent of the sales tax they generate within their borders limited to the 1 percent countywide sales tax only. Some of the cities that are currently in.

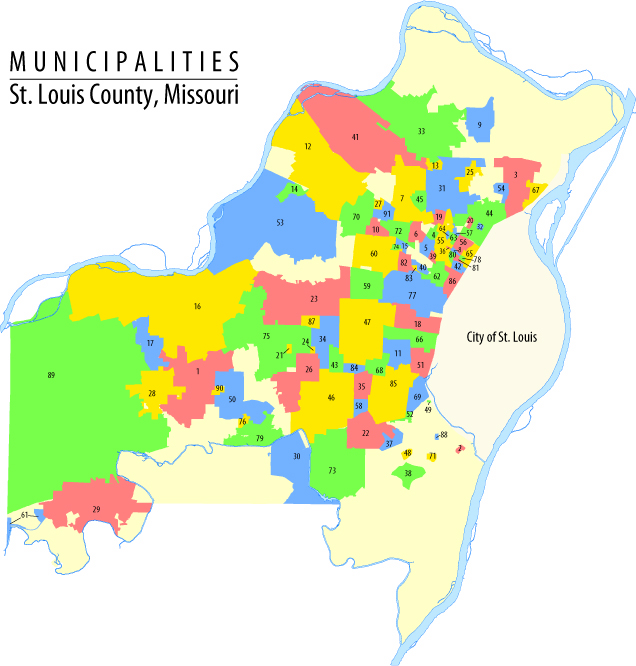

Louis County cities which were incorporated after March 19 1984 or areas annexed after March 19 1984 are automatically included in the sales tax pool under State law with no option. The annual debate about the Saint Louis County sales tax pool is being treated more seriously this year in the legislature according to reports I have. The City of Chesterfield receives a share of the county-wide 1 tax on retail sales through a pool comprised of unincorporated St.

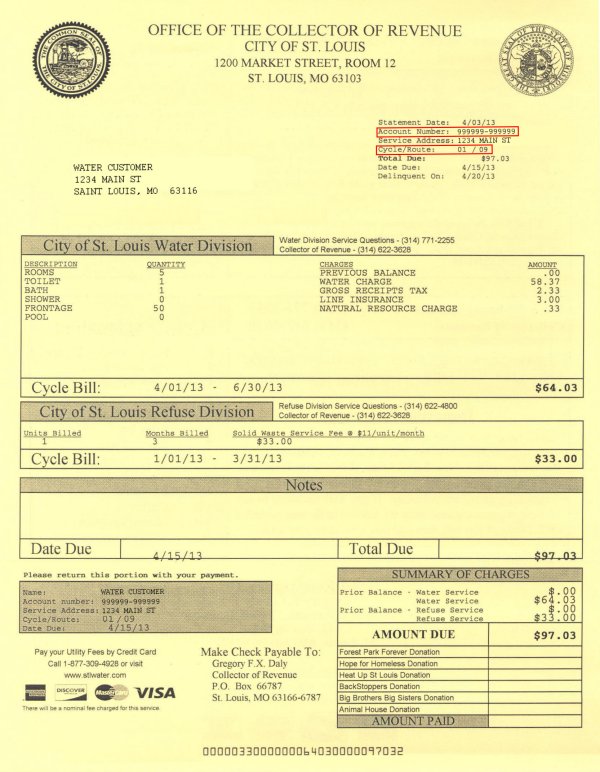

They keep most of the sales taxes collected within their boundaries but submit a portion to the pool. Pursuant to section 92840 of the Missouri Revised Statutes the successful bidder should wait at least two 2 weeks after the sale and then must file with Division 29 in the Circuit Court of the City of St. The pool or B cities which includes all unincorporated areas of St.

Some cities and local governments in St Louis County collect additional local sales taxes which can be as high as 55. A county-wide sales tax rate of 2263 is applicable to localities in St Louis County in addition to the 4225 Missouri sales tax. Most point-of-sale cities such as Des Peres have major shopping centers.

Thats because any sales tax thats generated in unincorporated St. The St Louis County Sales Tax is 2263. The Missouri Supreme Court on Tuesday rejected Chesterfields bid to keep more of the sales tax it generates.

Most point-of-sale cities such as Des Peres have major shopping centers. Louis County generally do not have large revenue producing facilities with some exceptions. Louis County and many of the cities throughout St.

Ad Lookup Sales Tax Rates For Free. JEFFERSON CITY The Missouri Legislature on Thursday approved giving Chesterfield and some other retail-rich St. Allen insisted that no city in St.

Heres how St Louis Countys maximum sales tax rate of 11988 compares to other counties. Pool cities by. 2117 2015 2948 Ridgeway Avenue St.

JEFFERSON CITY The Missouri Legislature on Thursday approved giving Chesterfield and some other retail-rich St. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St. For these reasons the B cities and the County pool all of the one cent sales tax revenue.

At issue was an arrangement detailing how St. Louis County cities a bigger share of the sales tax revenue collected within. State and Local Government Municipal Policy.

JEFFERSON CITY Certain cities in St. Louis County local sales taxesThe local sales tax consists of a 214 county sales tax and a 125 special district sales tax used to fund transportation districts local attractions etc. Cities in Saint Louis County are either point-of-sale or pool cities.

St louis county sales tax pool cities Wednesday June 8 2022 Edit. Pool cities by contrast share all the sales taxes they collect with other members of the pool. Louis a motion to confirm the sale of property and must have the appraiser at the confirmation hearing to testify to the reasonable value.

BALLWIN MO KTVI During Monday nights Ballwin alderman meeting officials voted and passed bill 38-71 for attorney John Hessel to. Louis County cities handle a 1 sales. Cities in Saint Louis County are either point-of-sale or pool cities.

Louis County would be negatively impacted by more than 18 percent in a. Brentwood Clayton Crestwood Des Peres Fenton Kirkwood Richmond Heights and St. In 2015 Allen along with Rep.

Louis County Missouri - St. Louis County Sales Tax is collected by the merchant on all qualifying sales made. Louis County is put into the pool which then goes into the countys coffers.

They include but are not limited to.

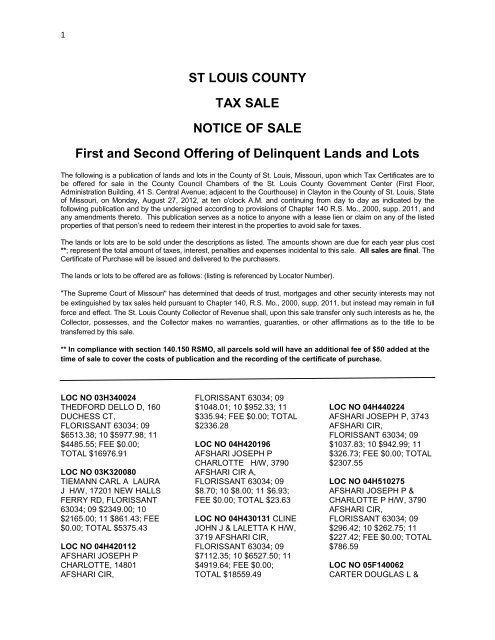

Properties Pile Up At St Louis County Tax Sales Politics Stltoday Com

Chesterfield Tries To Pee In The Tax Pool Nextstl

Understanding The Missouri Supreme Court Ruling On Sales Taxes Ksdk Com

Suggestions For The Joint Interim Committee On Saint Louis Msa Governance And Taxation Nextstl

St Louis County By Stltoday Com Issuu

St Louis County Tax Fight Heats Up As Region Seeks Economic Unity Nextstl

Oyo Hotel St Louis Downtown City Center Mo In St Louis Mo Book 192 And Get 33 Off

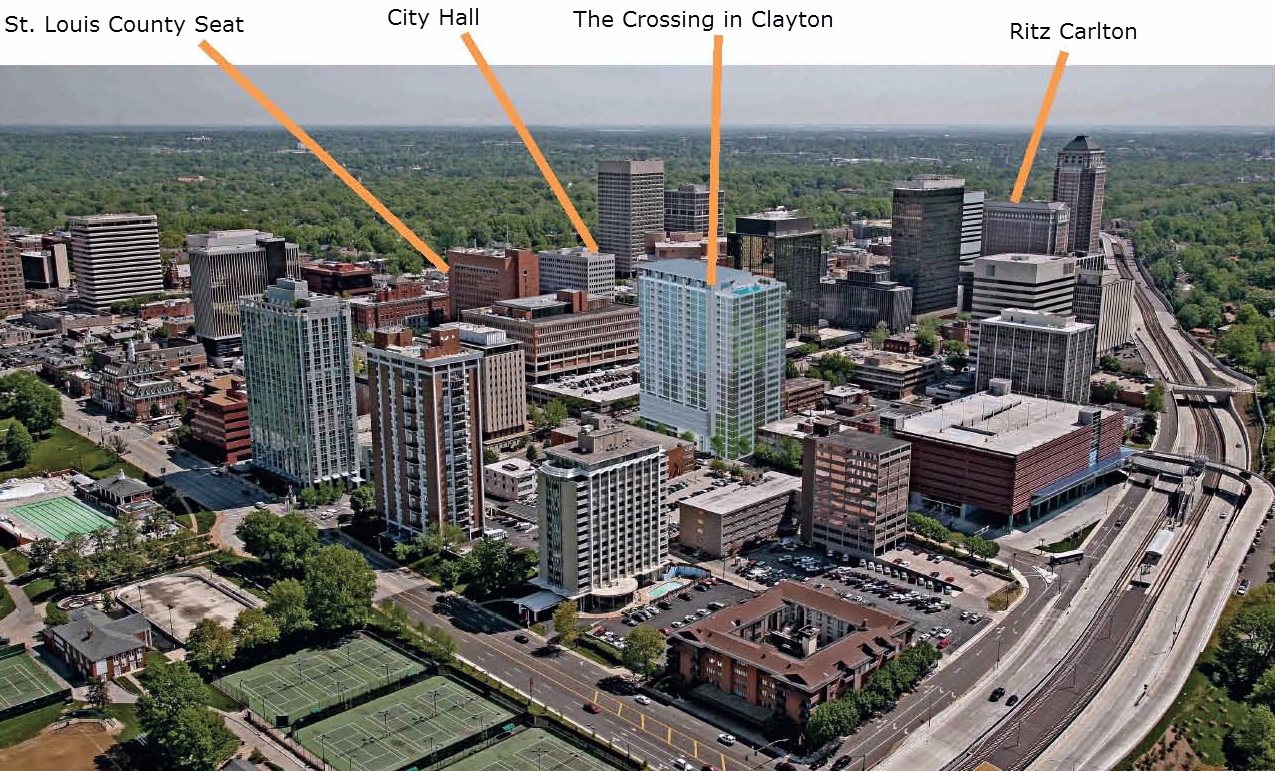

72m Twenty Four Story The Crossing In Clayton Receives Tax Abatement Nextstl

3 St Louis County Towns On List Of 100 Best Cities For Families In The Midwest

2022 Best Places To Live In St Louis County Mo Niche

St Louis County Tax Sale Notice Of Sale First And Second

Stl Area Misconceptions Treaty

La Quinta Inn Suites By Wyndham St Louis Route 66 St Louis Mo Hotels

Luxury Hotel St Louis Mo The Ritz Carlton St Louis

Opinion How Municipalities In St Louis County Mo Profit From Poverty The Washington Post

Days Inn Suites By Wyndham St Louis Westport Plaza Saint Louis Mo Hotels